mississippi property tax calculator

How To Calculate the Ad Valorem Tax on a Specific Parcel of Property Lets say a. Mississippi Salary Tax Calculator for the Tax Year 202223.

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

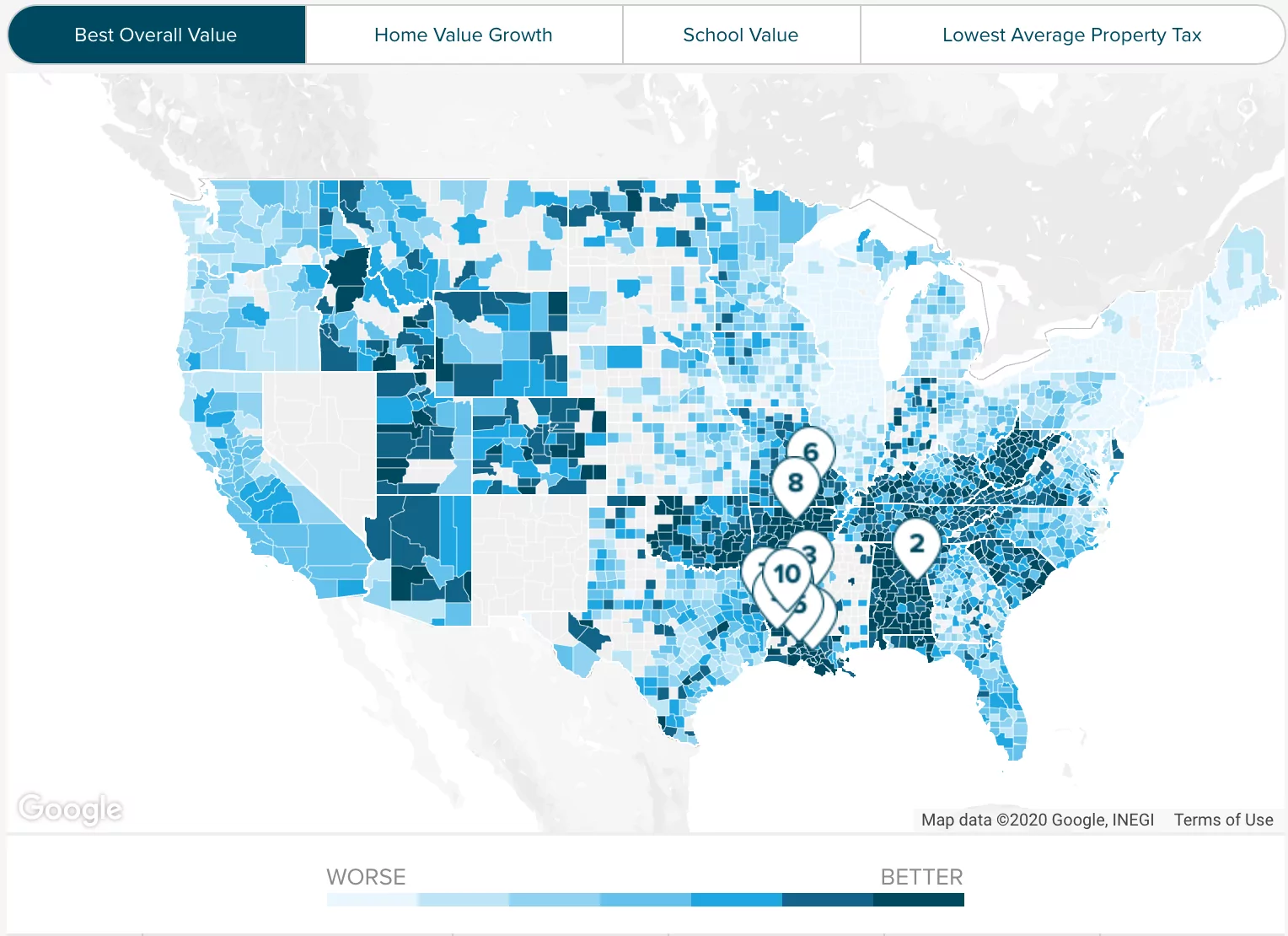

The median property tax in Mississippi is 50800 per year052 of a propertys assesed fair market value as property tax per year.

. Mississippi has one of the lowest median property tax rates in the United States with only three states collecting a lower median property tax than Mississippi. Mississippi tax year starts from July 01 the year before to June 30 the current year. The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes.

Mississippi state income tax. NO Homestead Exemption 15 Assessment. Property Taxes By State In 2022 A Complete Rundown The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the MS property tax calculator.

Ad Valorem Taxes - General Exemptions Title 27 Chapter 31 Mississippi Code Annotated 27-31-1 Ad Valorem Taxes-Homestead Exemptions Title 27 Chapter 33 Mississippi Code Annotated. M monthly mortgage payment. I your monthly interest rate.

Please call the office or look up your property record for an official amount due. Taxing authorities include city county governments. For comparison the median home value in Mississippi is 9800000.

Real Property Tax Estimate. L 1055 Public Schools in 163 School Districts educating 493540 students source. Search For Title Tax Pre-Foreclosure Info Today.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. The tax on liquor is equal to 746 per gallon. The following may be found at Mississippi Code at Lexis Publishing.

052 of home value. Ad Be Your Own Property Detective. Mississippis alcoholic beverage taxes on the other hand rank quite high compared with the rest of the nation.

This is strictly an estimate on annual property taxes and is based on the values that you enter. 94 of farm-raised catfish in the nation are raised in Mississippi. Actual tax amounts may varyThe data provided is for informational purposes only.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Real Property Tax Estimate. The median household income is 43529 2017.

See Property Records Tax Titles Owner Info More. In general there are three stages to real estate taxation. This is only an estimate based on the current tax rate and the approximate value of the property.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Tate County. Mississippi has one of the lowest median property tax rates in. 2012 Class of Counties.

Use of this information acknowledges my understanding of these conditions. Assessment ratios are 10 15 and 30. The assessed value is multiplied by the local property tax rate or millage rate to determine the property taxes owed.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Mississippis median income is 45925 per year so the median yearly property. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223.

The median property tax on a 10050000 house is 105525 in the United States. Local governments in Mississippi collect an average of 052 in property taxes each year according to the propertys assessed value. The median property tax in Mississippi is 50800 per year for a home worth the median value of 9800000.

Calculate your net salary after tax in Mississippi USA with our easy to use and up-to-date 2022 income tax calculator. Mississippi salary tax calculator for the tax year 202122. Property Tax Regulations.

For example this could potentially be through higher property taxes higher sales taxes fewer state services fewer state benefits etc. Please fill out the form below and click on the calculate button. Select the tax district to calculate the Mill Rate.

Estimated Taxes. Each entity then is given the assessment amount it levied. Tax amount varies by county.

When are Taxes for Mississippi Property Due. According to the Tax Foundation Mississippis cigarette tax is 68 cents per pack of 20 cigarettes. Equity in estimating real property throughout Mississippi is the target.

The appraised value of the property. In Mississippi Property Tax Revenues are Used to Fund. This is only an estimate of your tax due.

The median property tax on a 10050000 house is 52260 in Mississippi. Our calculator has been specially developed. Pike County - Property Tax Estimate Calculator County North Pike SD County South Pike SD County McComb SD Osyka Magnolia Summit McComb McComb SD McComb North Pike SD McComb.

Taxes for Mississippi property are due on or before February 1 for property assessed the preceding year. Search Any Address 2. This is a likely place to look carefully for evaluation disparities and oversights.

Once more the Mississippi Constitution sets rules related to appraisal techniques. This is an estimate only. NO Homestead Exemption 10 Assessment.

Mississippi has a population of over 2 million 2019 and is known as the catfish capital of the United States. P the principal amount. Counties in Mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year.

Your average tax rate is. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. If February 1 falls on a weekend taxes can be paid the subsequent Monday.

The median property tax in Mississippi is 508 per year based on the median home value in Mississippi 98000. This is only an estimate based on the current tax rate and the approximate value of the property. Establishing tax levies estimating property worth and then bringing in the tax.

Property taxes are the main source of funds for Natchez and the rest of local governmental units. Obviously each state will be different and this may not be the case in every state. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each.

Mississippi Income Tax Calculator 2021. Section 27-31-1 to 27-53-33 All property real and personal is appraised at true value and assessed at a percentage of true value according to its type and use. Property Tax main page forms schedules millage rates county officials etc Ad Valorem Tax Miss.

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Property Taxes Property Tax Analysis Tax Foundation

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Mississippi Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mississippi Property Tax Calculator Smartasset

Property Tax How To Calculate Local Considerations

Property Tax Prorations Case Escrow

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Understanding Mississippi Property Taxes Mississippi State University Extension Service

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

King County Wa Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Buyers L Property Buyers Property Building Elevation

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare